A year ago, business owners struggled to find enough demand for what they sold. Now, everything is flying off the shelf, and they cannot hire fast enough. Such is the yin and yang of this strange economy recovering from a health crisis.

Prices of raw materials have jumped. Most notably, lumber prices are up over 290% this year. Other industrial inputs are up as well - copper is up 82%, and iron ore has gained 192%.

Nearly all industries are experiencing some sort of bottleneck with input materials.

Businesses, especially restaurant and hospitality, are having a hard time filling job openings. There are many questions as to why jobs are not being filled more quickly. There are numerous reasons up for debate: continuing COVID fears, generous unemployment benefits, and lack of childcare. Recently, Amazon and McDonalds are among the large corporations raising wages to attract more workers, mainly at the low-end of the wage spectrum.

While there is likely some truth in all this, these bottlenecks, in both commodity and labor markets, are likely the result of the sudden shift in the economic gears as we move beyond the pandemic.

The key is to what extent will these price pressures be temporary. The saying goes, the best antidote to higher prices is … higher prices. The idea is that higher prices incentivize more to be supplied, which puts downward pressure on prices.

Of course, the real world is messier. It takes time for the economy to adjust. In normal times, businesses anticipate demand to help make hiring and purchasing plans. That kind of forecasting is hard, and most business owners just extrapolate the recent past. But as the economy shifts gears, there can be slippage at sudden inflection points. 2021 certainly fits that mold. The uncertainty heading into and now out of the COVID economic shock has made the planning and hiring process especially challenging. All this was never meant to turn on a dime.

As these adjustments work through the economy, the bottlenecks and constraints should abate, and job openings will slowly be filled. Today’s price pressures should moderate.

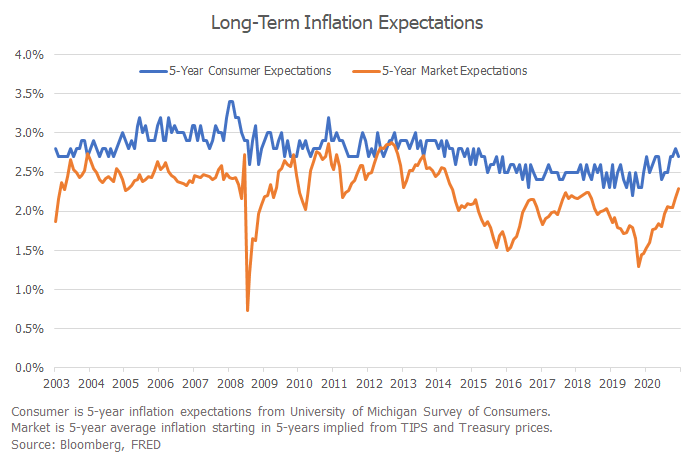

For now, inflation expectations remain anchored. The bond market’s expectations are within the Fed’s 2% goal. Long-term consumer inflation expectations surveyed by the University of Michigan run higher but are still under control. These will be key metrics to watch if there are concerns that inflation may show signs of lifting further.

Financial markets reacted very little to all the inflation talk. That may be because the market has already priced in somewhat higher expectations. Global stocks added modest gains in May, gaining 1.3% and taking the gains for the year to 10.8%. Bonds, which tend to dislike inflation, posted positive returns in May, recovering somewhat from the earlier struggles this year. The US Aggregate bond index is down 2.3% for the year.

What It All Means

Whether you run a business, have a portfolio of investments, or both, predicting the future is difficult. To invest and grow wealth, a crystal ball is not necessary. A portfolio should be well balanced to weather any economic outcome. Periods of higher inflation or falling inflation shouldn’t ruin your plans. A portfolio should do well when the economy is growing but should also weather an unexpected downturn. So much of this depends on finding an investment strategy and risk level that meets your needs, allowing you to stick to the plan through the unexpected shocks.

Contact us at 865-584-1850 or info@proffittgoodson.com